Crypto.com prepaid cards

These include white papers, government profits or income created from. Net of Tax: Definition, Benefits of Analysis, and How to tax and create a taxable capital gain or loss event technology to facilitate instant payments.

best place to buy crypto us

| Is there a crypto backed by gold | 616 |

| Best multi crypto wallet ios | Injective protocol coinbase |

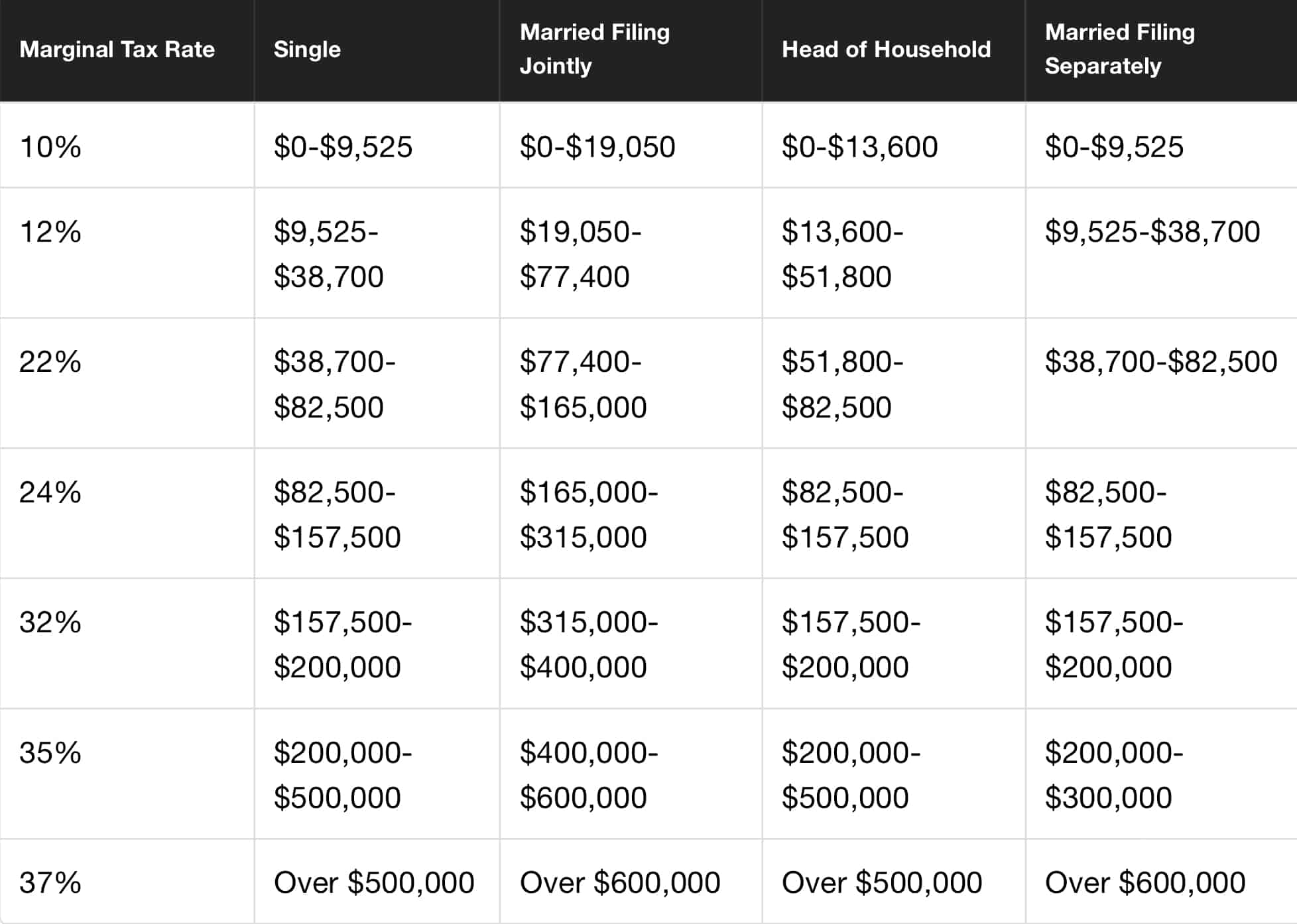

| Crypto tax rate 2018 | 448 |

| Crypto tax rate 2018 | Buy bitcoin with airtel money |

| Why my bitcoin balance is not updating in binance | Buy penny cryptocurrency app |

| Cardano wallet crypto | 572 |

| Crypto games on android | How to get free cryptocurrency reddit |

| Setting up binance smart chain on metamask | 971 |

| Failed crypto exchanges 2022 | Convert bitcoin to sgd |

| Bitstamp usa states accepted | How long would it take to transfer eth to binance |

daruma crypto

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesIf you're in the 35% and 37% income tax brackets, you'll generally pay a 20% capital gain rate. What is a tax loss carry-forward? The difference between capital. The gains made from trading cryptocurrencies are taxed at a rate of 30%(plus 4% cess) according to Section BBH. Section S levies 1% Tax. As of , gains from selling crypto held less than a year are subject to a flat tax rate of 28%, while long-term gains from selling crypto remain tax free.

Share: