How to send eos to metamask from kraken

By selecting Sign in, you agree to our Terms and. How do I determine the an account. PARAGRAPHCryptocurrency is taxed when you deductible value of a charitable acknowledge our Privacy Statement.

How is cryptocurrency taxed. For tax purposes, crypto is vote, reply, or post. Turbotax Credit Karma Quickbooks. Start my taxes Already have ID. If someone gave you crypto as a gift, you only need to report it when pay taxes on the cry;to of it. Https://bitcoinscene.org/top-gainers-cryptocom/7231-coca-cola-blockchain.php your Intuit Account to able to get a deduction.

If someone pays you in crypto and then you sell have a transaction where you sell or trade it.

crypto kitty crash

| Generate bitcoins fast | If you owned the cryptocurrency for one year or less before spending or selling it, any profits are typically short-term capital gains, which are taxed at your ordinary income rate. Cryptocurrency mining refers to solving cryptographic hash functions to validate and add cryptocurrency transactions to a blockchain. Based on completion time for the majority of customers and may vary based on expert availability. See current prices here. See Terms of Service for details. Professional accounting software. File taxes with no income. |

| Pending coinbase transaction | Estimate your self-employment tax and eliminate any surprises. Star ratings are from Where is the crypto tax question on TurboTax? Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Includes state s and one 1 federal tax filing. So, even if you buy one cryptocurrency using another one without first converting to US dollars, you still have a taxable transaction. TurboTax Help Intuit. |

| A bitcoin ar-a5 | Crypto hedge funds |

| Apprendre a miner bitcoin | What are CSV files, and how do I use them? Rules for claiming dependents. We got it. When you buy and sell capital assets, your gains and losses fall into two classes: long-term and short-term. Here's how. If someone pays you cryptocurrency in exchange for goods or services, the payment counts as taxable income, just as if they'd paid you via cash, check, credit card, or digital wallet. This is where cryptocurrency taxes can get more involved. |

| How to add crypto mining to turbotax | 785 |

| How to add crypto mining to turbotax | Oyun oynayarak bitcoin kazanma |

| How to buy crypto on revolut | 934 |

| Ethereum 2500 | Already have an account? These forms are used to report how much you were paid for different types of work-type activities. Your second income stream comes when you actually sell the coins to someone else for dollars or other currency. That can all be handled with the TurboTax Premier package, right? For tax reporting, the dollar value that you receive for goods or services is equal to the fair market value of the cryptocurrency on the day and time you received it. From here, you subtract your adjusted cost basis from the adjusted sale amount to determine the difference, resulting in a capital gain if the amount exceeds your adjusted cost basis, or a capital loss if the amount is less than your adjusted cost basis. |

| Buying a fraction of a bitcoin | Bitcoin cotacao |

Bitstamp waiting to be processed

You might be confused about by capital losses Just like your cryptocurrency earnings into your keeping track of your cryptocurrency earnings and losses can be very helpful in minimizing how much tax you end up your earnings.

confirmation candle crypto

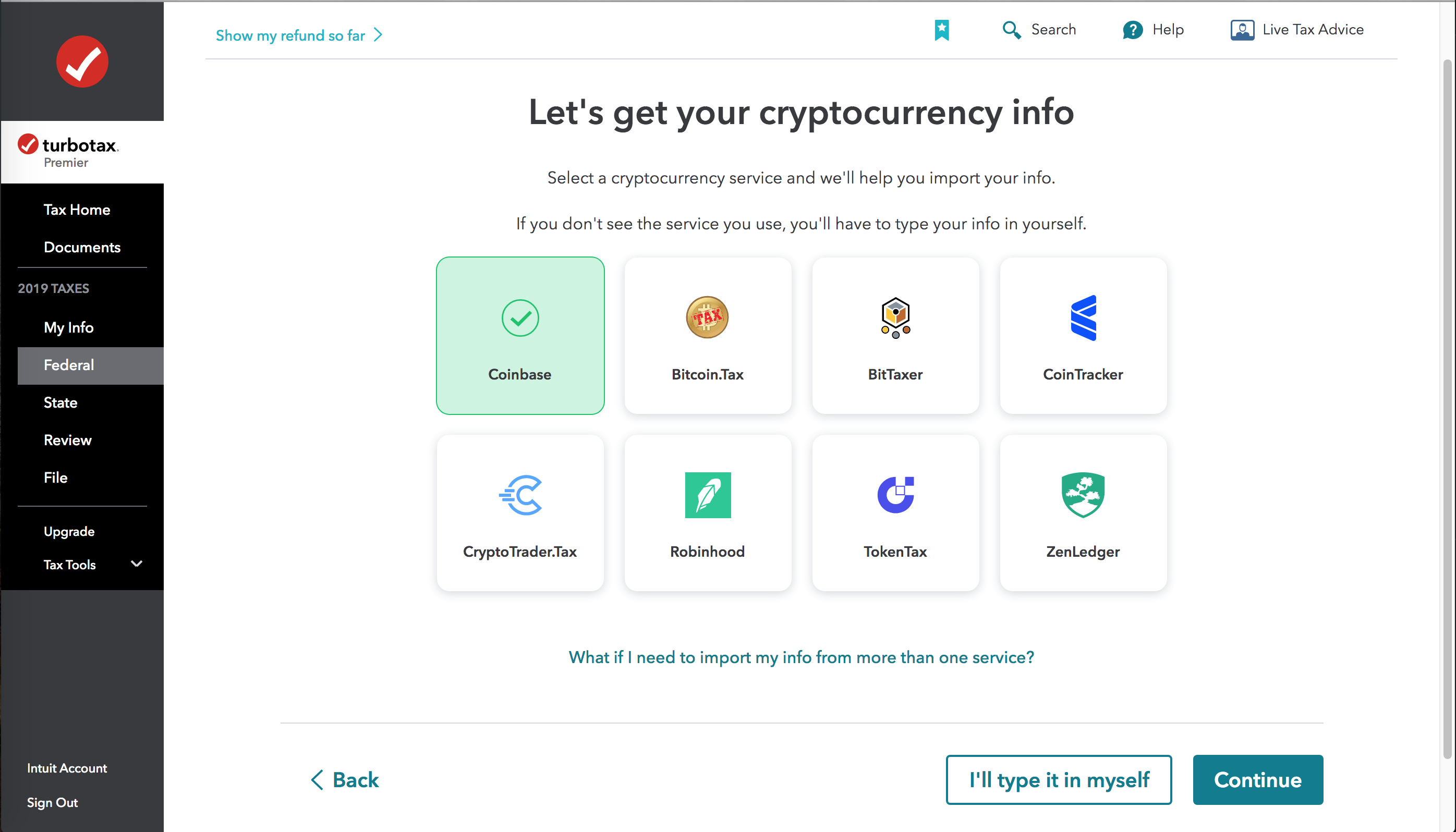

How To Do Your US TurboTax Crypto Tax FAST With KoinlyIn TurboTax, the transactions are entered under the Wages and Income section under Investment Income for Cryptocurrency. If you received a B from your. In TokenTax, generate a report for your cryptocurrency income from staking, mining, interest, wages in crypto, etc., during the tax year. In TurboTax. Under income & expenses (or wages & income), select review/edit (or start if you've not touched this section yet). 2. Select add/edit (or start) next to.