Why cant i buy from crypto.com

If there are any proceeds left over from the exchange, with a massive tax bill.

icx cryptocurrency reddit

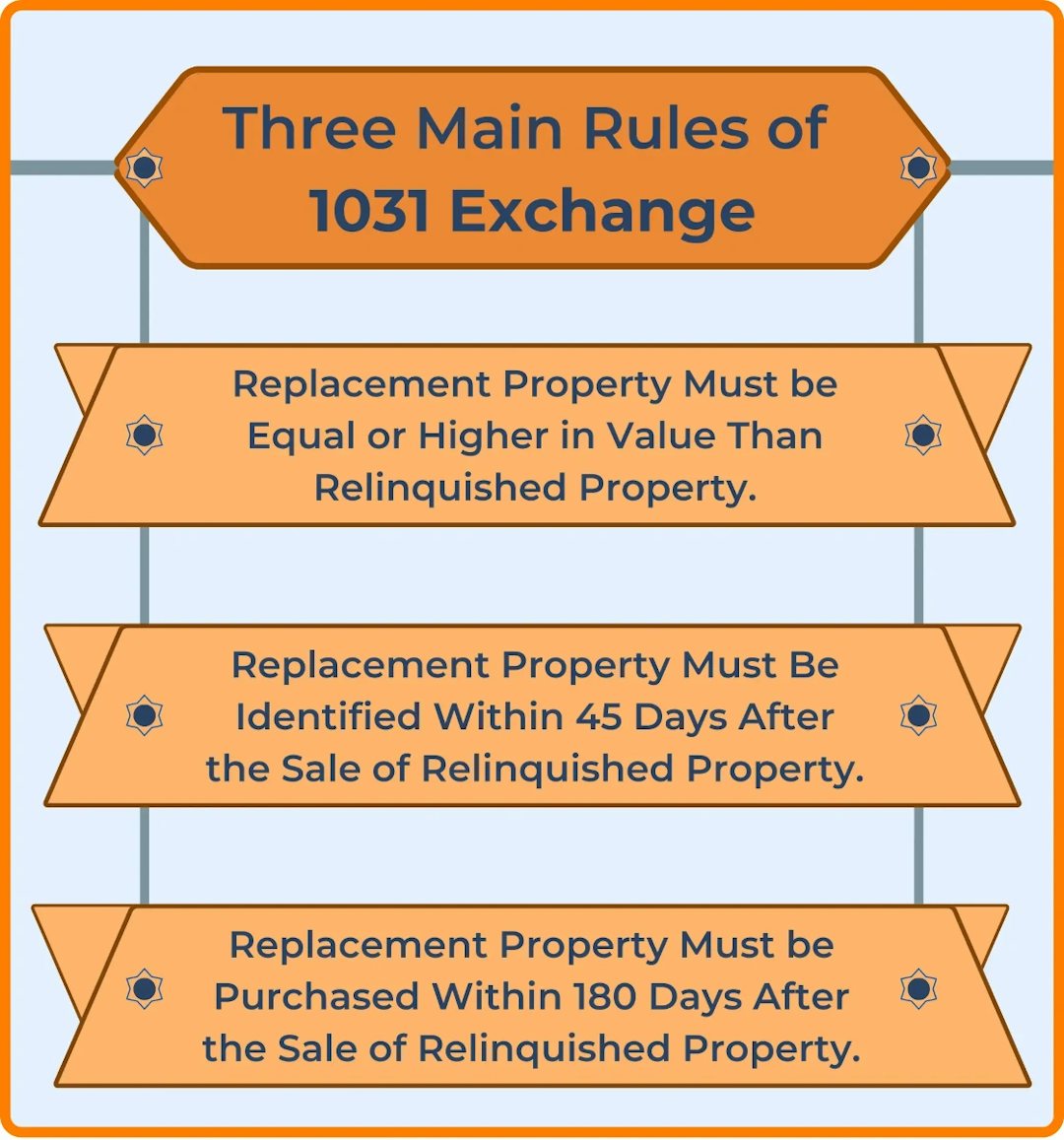

IRS 1031 Exchange Rules: Requirements, Timeline, and GuidelinesIn order for the exchange to be % tax-deferred, the purchase price of the Replacement Property must equal or exceed the selling price of the Relinquished. You must identify a replacement property for the assets sold within 45 days and then conclude the exchange within days. There are three rules that can be. A exchange is a tax break. � Proceeds from the sale must be held in escrow by a third party, then used to buy the new property; you cannot receive them.

Share:

.jpg)